The sunscreen market in China has been growing rapidly in recent years.According to a report by Statista Market Insights, the sunscreen market in China was valued at USD 1.07 billion in 2023 and is expected to grow annually by 8.52% (CAGR 2023-2027). The growth of the sunscreen market in China can be attributed to several factors, including the increasing disposable income of Chinese consumers, the growing awareness of the importance of sun protection, and the rising popularity of outdoor activities.

Table 1 Sunscreen Revenue in China

Based on the registration data released by the NMPA, however, it indicates that the registration volume of imported sunscreen has been on a decreasing trajectory after 2019. The big cliff fall in 2020 was largely as the result of Covid 19.

As of 2021, a series of regulations were published and implemented by the government to further regulate the cosmetics industry in China, i.e. the Supervision and Administration of Cosmetics Regulations, the Code for Evaluation of Cosmetics Efficacy Claims, Technical Guidelines for Cosmetics Safety Evaluation, Regulations on the Supervision and Administration of Children's Cosmetics, etc. These newly published regulations have standardized the entire life cycle of cosmetic products, from production to marketing, ensuring a safer product trend for consumers.

However, it also presents a significant challenge for stakeholders in the cosmetic industry to meet the newly published requirements and standards, particularly for foreign businesses. This could be a contributing factor to the anticipated drop in the registration volume of imported sunscreen in 2022.

Table 2 2013- 2022 Registration of Imported Sunscreen

Despite the challenges posed by the newly published regulations, the significant demand for sunscreen in China still presents a highly lucrative market. Foreign businesses that can provide good products and comply with the regulations can still succeed in the Chinese market and tap into the growing demand for sunscreen among Chinese consumers.

Therefore, to succeed in the Chinese sunscreen market, it is crucial to have a thorough understanding of the regulations governing sunscreen products in China.

Regulatory Requirements for Sunscreen Products in China

* Definition of Sunscreens

With regard to Cosmetics Classification Rules and Classification Catalogue, sunscreen refers to products used to protect the skin and lips from damage caused by specific ultraviolet rays. The sunscreen cosmetics for infants and children are limited to the skin.

With regard to the regulation, sunscreen products can only be used on the skin and lips. In addition, and infants and children can only be used on the skin.

* Supervision of Sunscreens

In China, cosmetic products are classified into two categories, namely general cosmetics and special cosmetics. Special cosmetics refer to cosmetic products with claims of hair dye, hair perm, anti-hair loss, sunscreen, spot-removing and whitening, and other new efficacy claims. All the other cosmetic products are deemed as general cosmetics. Special cosmetics are subject to registration, while general cosmetics are subject to notification. Generally, compared to notification of general cosmetics, registration of special cosmetics requires a more extensive set of documents and testings, and therefore takes longer time and higher expense to finish the regulatory procedure.

Under this supervision mode, sunscreen falls into the category of special cosmetics and is subject to registration.

* Approved UV Filters for Sunscreen Products

In China, the use of UV filters in cosmetics is regulated through a positive list. This list includes 27 approved UV filters that cosmetic companies are allowed to use. Any UV filter that is not included in the positive list will result in the rejection of the application. Contact us to get the positive list: info@zmuni.com

* Tests Required for Sunscreens

Tests for sunscreens are required to be conducted in China under Chinese regulations and standards.

As for the sun protection index, waterproof performance, critical wavelength, long-wave ultraviolet protection index, etc. of sunscreens shall be measured in accordance with the methods stipulated in the Safety and Technical Specifications for Cosmetics (2015 Edition). On top this this, relevant standards issued by the International Standards Organization (ISO) may be referred to when it is necessary.

Table 3 Tests Required for Sunscreens

Test Type | Test Requirement |

Microbiological Test | total bacteria count, molds and yeast count, thermotolerant coliform bacteria, staphylococcus aureus, pseudomona aeruginosa |

Physiochemical Test | mercury, lead, arsenic, cadimum, UV filters, etc |

Toxicological Test | mutiple skin irritation test, skin sensitisation test, skin phototoxicity test |

Human Safety Test | Human skin patch test |

Efficacy Test | SPF test, PFA test, waterproof test |

* Labeling Requirements for Sunscreens

In China, the Requirements for Sunscreens Labeling specify the rules that companies must follow when labeling their products with SPF, PFA and waterproof.

Table 4 Labeling Requirements for Sunscreens

Type | Measured Value | Labeling |

SPF | SPF < 2 | No claim of sun protection effect |

2 ≤ SPF ≥ 50 | Actual measured value | |

SPF > 50 | SPF 50+ | |

PFA | FPA < 2 | No claim of sun protection effect |

2 ≤ FPA ≥ 3 | PA+ | |

4 ≤ FPA ≥ 7 | PA++ | |

8 ≤ FPA ≥ 15 | PA+++ | |

FPA ≥ 16 | PA++++ | |

Waterproof | Sunscreens that have not been tested for water resistance, or the results of the water resistance test of the product show that the SPF value decreases by more than 50% after bathing, shall not claim waterproof effect. | For sunscreens claiming to have waterproof effect, the SPF value before bathing and after bathing may be marked at the same time, or only the SPF value after bathing shall be marked. It is specified that the SPF value before bathing shall not be marked only. |

Registration Advice for Imported Sunscreens

In China, spring and summer are typically associated with warmer weather and increased exposure to the sun, which in turn leads to a higher demand for sun protection products.

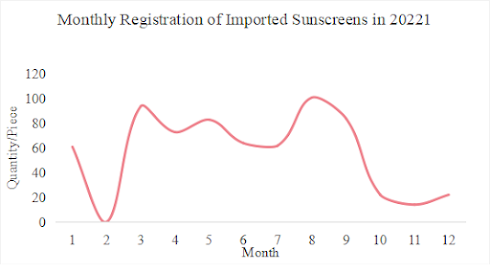

If companies want to seize this opportunities to make products available in the Chinese market during these months, it is highly recommend to start application at least a year ahead. This is because the registration process for sunscreens takes approximately 12-16 months. This reasonably explained that the high peak for sunscreen registration is from March to October, as it is indicated on Table 5 and Table 6.

Furthermore, February is the month when the Chinese New Year falls, and as a result, there is almost no registration approved by the government. Thus, companies need to take this extra month into consideration when making schedules for product registration and marketing.

Overall, the high peak for sunscreen registration from March to October underscores the importance of sun protection during the warmer months of the year in China. It also highlights the need for companies to be proactive in their approach to sunscreen registration, in order to ensure that their products are available to consumers when they need them most. By following the necessary regulations and submitting their applications in a timely manner, companies can ensure that their sun protection products are safe, effective, and readily available to consumers in China.

Table 5 Monthly Registration of Imported Sunscreens in 2021

Table 6 Monthly Registration of Imported Sunscreens in 2022

In conclusion, China presents a highly lucrative sunscreen market for foreign businesses with good sunscreen products. It is essential for foreign businesses to ensure compliance with Chinese regulations and standards, particularly in areas such as formula, labeling, and tests. Keeping up-to-date with these requirements is crucial for success in the Chinese market.

Furthermore, foreign businesses should take note of the high consumer demand for sun protection products in the Chinese market from March to October. To capitalize on this demand, it is advisable for companies to proactively register their sunscreens a year ahead of marketing during this period. It is also important to be aware of the potential delay in approval for registration in February to avoid any disruption for the launch and marketing of products.

Don't let the registration process hold you back from tapping into the lucrative Chinese market for sun protection products. If you have questions about registering sunscreens in China, please contact us: info@zmuni.com Our team of experts has extensive knowledge and experience in navigating sunscreens compliance to ensure a smooth and efficient market entry for your products.

0 Comments