COVID-19 was an unprecedented crisis on a global scale. E-commerce for goods and services has been adversely impacted. But international cooperation is needed to keep trade flowing. In the midst of significant uncertainty, there are hopes and opportunities for the cosmetics industry to open a new way forward.

According to the Chinese NDRC report in 2019, the general Chinese economy is growing extremely fast. Chinese residents’ income continued rising, and the middle-class groups in China have expanded. And the need for cosmetic consumption in the Fashion and Beauty industry has become the new spotlight of the Chinese market.

There are three elements that make the Chinese cosmetic market interesting for cosmetic brands to enter.

First, the scale of the Chinese cosmetics industry is growing fast.

From January to September in 2019, the retail sales of cosmetics in China were worth over 33.4 billion US dollars, an increase of 12.8% compared to last year, which has been the second fastest retail growth rate of all commodities in the Chinese market. A total of 162,000 tons of cosmetics was exported, a year-on-year increase of 3.4%. And the number of cosmetic production exports was approximately 2.1 billion US dollars, which increased by 16.6% by 2019.

Second, the need for cosmetic consumption in China keeps rising.

By the end of 2018, the size of the cosmetic markets in China has reached 64 billion US dollars. It holds 12.7% of the cosmetics market in the world and maintains the status of the world's second-largest cosmetic market. From January to September 2019, The total Chinese import volume of cosmetics was 167,000 tons, which has increased by 11.9% since 2018. And cosmetic imports worth approximately 6.6 billion US dollars, which increased by 39.9%.

Even China now is the 2nd largest cosmetic market in the world. It still has a tremendous space for cosmetic companies to grow.

According to statistics at the end of 2018, Chinese per capita consumption of cosmetics was only 45 US dollars, lower than 200 US dollars which were compared with per capita consumption in Europe, America, Japan and South Korea. But it is steadily growing. By 2019, the disposable income and consumption expenditure of Chinese residents are showing a dual growth trend, and the level of consumer demand is shifting to high-end personalized consumption. With the consumption upgrade trend, the per capita consumption of Chinese cosmetics is expected to continue to increase.

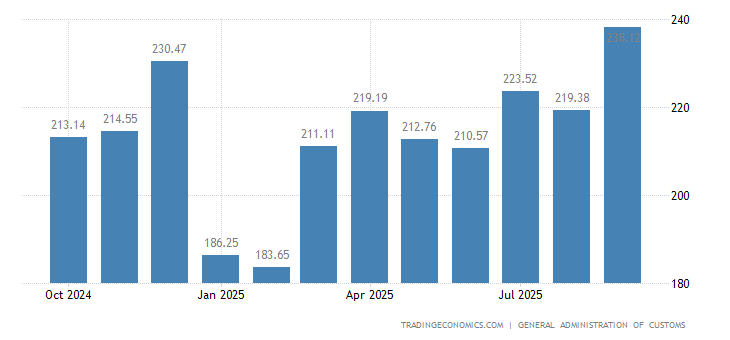

Although Chinese exports took a hit early in the pandemic, they have recovered quickly and have kept rising beyond pre-pandemic levels with imports following a similar trend.

Chinese Imports in USD

|

Data taken from "National Development and Reform Commission (NDRC)"

————————————

0 Comments